Table of Contents

If you’re looking for one of the best tax lien markets and overall best states for tax lien investing in 2024, Alabama is a great place to start. With some of the highest interest rates in the country—up to 12% annually—Alabama offers plenty of opportunities for investors looking to earn solid returns.

But not all counties in Alabama are created equal. Some markets stand out because of strong job markets, high rental demand, and steady growth. In this article, I’ll walk you through the seven best counties for tax lien investing in Alabama based on the numbers, not guesswork.

Why Alabama Is a Hotspot for Tax Lien Investing

Alabama’s tax lien market is attractive for a few key reasons:

- High Interest Rates: Investors can earn up to 12% annually on unpaid taxes.

- Affordable Properties: Home prices in Alabama are lower than the national average, making it easier to get started.

- Three-Year Redemption Period: Property owners have three years to pay back their debt, giving you time to earn interest.

- Growth Opportunities: Many areas are experiencing population growth and rising home values, creating long-term potential.

What Makes a County a Good Investment?

When evaluating Alabama’s counties, I focused on six key factors:

- Low Unemployment: Counties with lower unemployment have stronger economies, making them more attractive to buyers and renters.

- Population Growth: Growing populations mean rising housing demand.

- High Rent Prices: Higher rents create better cash flow opportunities.

- Occupancy Rates: High occupancy means fewer vacancies and steady income.

- Property Appreciation: Areas with rising home values are safer bets for long-term gains.

- School Ratings: Good schools attract families and stable tenants.

7 Best Tax Lien Markets in Alabama

1. Limestone County – Best Overall (4.5/5)

Limestone County comes out on top because it checks nearly every box. It has a low unemployment rate of 2.8% and a high occupancy rate of 96.1%. The county’s average rent of $1,609 makes it attractive for rental income, and it has a steady 6.15% appreciation rate.

With population growth at 3.4%, Limestone is a strong market for both short- and long-term strategies.

Why Limestone Works: Its strong economic fundamentals make it an ideal location for investors who value stability and growth. The high occupancy rate reduces risk, and steady rent prices mean reliable cash flow.

Pro Tip: Focus on properties near schools and major highways—they tend to rent quickly.

2. Baldwin County – Best for Growth (4.5/5)

Baldwin County is booming. Its appreciation rate is 11.76%, one of the highest in the state, making it ideal for investors looking for fast equity gains. Unemployment is low at 2.9%, and average rents of $1,550 offer solid cash flow.

Population growth is another bright spot—up 2.8%—and the area continues to attract new residents.

Why Baldwin Stands Out: Growth equals opportunity. Baldwin’s rising property values make it perfect for investors focused on flipping properties or riding appreciation trends.

Pro Tip: Look for properties in areas undergoing new development. Growth often follows infrastructure improvements.

3. Shelby County – Best for Stability (4.2/5)

If you prefer stability, Shelby County is your best bet. It boasts Alabama’s lowest unemployment rate at 2.4% and an impressive occupancy rate of 94.7%. The schools are excellent (rated 90), which helps attract long-term tenants.

Rents average $1,583, and appreciation sits at 7.9%, providing a mix of cash flow and equity growth.

Why Shelby Appeals to Families: Good schools make Shelby a family-friendly market, which means tenants tend to stay longer. It’s ideal for long-term rental strategies.

Pro Tip: Properties near parks and schools tend to have lower turnover rates, making them ideal for long-term rentals.

4. Madison County – Best for Rentals (4.1/5)

Madison County is perfect for investors focused on rental income. The average rent price is $1,609, and the 92.8% occupancy rate means demand for housing is high.

Unemployment is just 2.6%, and appreciation rates are steady at 5.05%, offering a balanced investment opportunity.

Why Madison Draws Renters: Its growing population and solid job market create consistent demand for rentals, making it a reliable market for passive income.

Pro Tip: Multi-family properties can help maximize cash flow in high-rent markets like Madison.

5. Randolph County – Best for Appreciation (4.0/5)

Randolph County stands out for one key reason—appreciation. Home values here have surged 27.19%, making it ideal for investors looking for quick equity gains. At the same time, median home values remain affordable at $169,780.

Unemployment is slightly higher at 3.2%, but the county’s growth potential outweighs the risk.

Why Appreciation Matters: If building equity quickly is your goal, Randolph offers strong upside potential for those willing to invest in rising markets.

Pro Tip: Target fixer-uppers that need minor updates to capitalize on appreciation potential.

6. Elmore County – Average Option (3.8/5)

Elmore County offers balance. It has low unemployment (2.7%) and a high occupancy rate (91.3%). Rents average $1,275, and schools score a respectable 85.

While appreciation rates are moderate at 6.5%, Elmore provides a safe, steady option for investors.

Pro Tip: Look for properties near new developments to take advantage of future growth.

7. Morgan County – OK for Beginners (3.5/5)

Morgan County is a solid pick for entry-level investors. It has affordable home prices ($198,440) and decent rents ($1,325). Unemployment is low at 2.7%, and the occupancy rate is 90.5%.

Pro Tip: Stick to properties near major roads and shopping centers for maximum rental appeal.

Key Trends and Observations

- Market Stability: Counties with low unemployment and high occupancy rates offer predictable returns.

- Appreciation Hotspots: Counties like Randolph show fast-growing values for quick profits.

- Rental Income Potential: Areas with higher average rents, such as Madison and Limestone, are ideal for cash flow.

Final Thoughts

Alabama’s tax lien market is packed with opportunities for 2024. Whether you’re chasing high appreciation, steady rents, or affordable entry points, there’s something here for every investor.

If you’re new, start small in affordable counties like Morgan. If you’re experienced, target fast-growing markets like Baldwin or Limestone. The key is to act on the data, stay organized, and keep learning.

Next Steps:

Research county auction dates.

Register for online platforms like GovEase to bid remotely.

Focus on properties with strong demand indicators—low unemployment, high rents, and good schools.

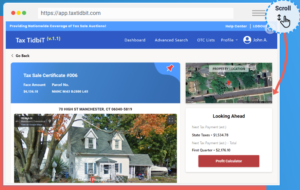

Pro Tip: You can certainly continue to research these tax liens the long way which is 100% free but very tedious and time-consuming, or you can use a high-quality research software such as Tax TidbiT to get your time back!

Image Credit: Tax TidbiT Homepage

They Provide:

Access To Upcoming Auctions

Access To Property Reports

Access To Over The Counter List Downloads

Access To Auction Raw List Downloads

And Much More!

Sign Up For A 7-Day Trial Today.

Finally, I believe the best way I’ve found to learn is by doing and “failing forward” as they say.

I bought my first investment property in 2020 during the middle of (you know what… cough.. cough), and I had no clue what I was doing despite spending months researching how to invest in real estate.

But guess what? I did it.

And learned a ton of valuable lessons along the way!

So, If you’re truly interested in tax lien investing, consider subscribing to my newsletter and following along my journey from landlord to “Lienlord” as a new tax lien investor.

As Lienlord grows, I aim to provide a “behind the scenes” inside look at the tax lien auctions I participate in and thoroughly profile any properties I win.

You’ll get to ride along with me as I walk through my risk analysis, deal structures, ROI calculations, bidding tactics, and exit strategies all documented for the world to see (even my L’s).

So please show your support by signing up for my newsletter, or if you are a Google Chrome user, hit that “follow” button!

(screenshot instructions found on my about page:))

Additionally, if you’re interested in booking a consultation to discuss tax lien strategy, feel free to schedule one here.

P.S. I am still fairly new to tax lien investing but I am willing to share what I’ve learned so far, so please keep that in mind before you book!

I’m not an expert… (yet)

I look forward to having you in the Lienlord community!

**Disclaimer

I am not a lawyer, financial advisor, or tax professional. This article is based on my research and experience as a tax lien investor. The information provided is for educational purposes only and should not be considered legal, financial, or tax advice. Always consult with qualified professionals before making any investment decisions or taking action related to tax liens. Laws and regulations vary by jurisdiction and can change over time, so verify all information independently. Investing in tax liens carries risks, and past performance does not guarantee future results.

![You are currently viewing 7 Best Tax Lien Markets in Alabama for 2024 [Ranked]](https://lienlord.co/wp-content/uploads/2024/09/word-image-1179-1.png)